AI and Competition Law

- Smriti Suri

- Feb 3

- 7 min read

Written by : Smriti Suri, B.B.A. LL.B.(Hons) , Graphic Era Hill University, Dehradun

-Herbert Hoover

Summary

Competition Law and AI reshape businesses, aiding global deals and antitrust checks. Their synergy enhances safety, transparency, and predictiveness in operations, making the business landscape more efficient and dynamic.

Introduction

Imagine that you want to go from point A to point B, and for that, you have to take the help of public transport. There are only two vehicles running on that road. They are changing the fees according to their own will. Leaving no other option for the passengers but to support that transport. This is known as ill practice, and in the same way, similar types of practices are being followed in the businesses. Therefore, in order to stop the enterprises from following such practices, the Competition Act has been passed.

Ø Origin of Competition Law

The journey of Competition Law starts in the 18th century. It was first introduced by Adam Smith through his book ‘Wealth of Nations’. The book was published in 1776. However, the very first anti-trust legislation can be dated back to the late 19th century. The legislation was known as ‘The Sherman Act, 1890 ’.

In the case of Northern Pacific Railway Co. v. United States[1],[2], Black J. held that “The Sherman Act was designed to be a comprehensive charter of economic liberty aimed at preserving free and unfettered competition forces will yield the best allocation of our economic resources, the lowest prices, the highest quality and the greatest material progress, while at the same time providing an environment conducive to the preservation of our democratic political and social institutions.”[3]

Ø Indian History of Competition Law

For the first time in India, Competition Law was introduced in the form of the ‘Monopolies Restrictive Trade Practices Act’ (MRTP) in 1969. The bill was introduced in 1967 and referred to the Joint Select Committee. It came into effect on June 1, 1970.

As the nation was moving towards its advancement, the legislature felt that there was a need to replace old laws with new ones. Therefore, based on the SVS Raghavan Committee’s report, the Central Government decided to replace the MRTP Act with the Competition Act, 2002. So that the nation can cope with the ongoing changes in business and market conditions, along with economic conditions, both within and outside India, The main aim was to protect the freedom of enterprise at the market place.

Cross – Border Implications of AI and Competition Law

Ø India beyond its Territories

“The term “cross-border merger” is used to describe mergers and acquisition to describe mergers and acquisitions involving companies based in separate nation.” [4]. For instance, there are two companies: Company A from India and Company B from Australia. Both companies decide to merge together. As a result, this merger will be known as a cross-border merger. In India, international mergers and acquisitions, i.e., between India and foreign countries, have been allowed after the implementation of the Companies Act, 2013. In contrast, such mergers and acquisitions are regulated as per the rules provided under the Companies Act, 2002.

Ø Implication

AI helps in the formulation of strategies, which identify targets, the evaluation of risks, and the alignment of activities with the goals and visions of the company[5]. It also helps in identifying future market trends, which are more accurate and deeply researched as compared to manual findings. AI also takes into account financial, operational, and legal aspects that have the capacity to affect such mergers. AI not only helps in connecting with potential companies and the risks involved but will also provide solutions to overcome such risks.

AI leads to detailed analysis involving various details with regards to the companies, their strategies, workings, assets, liabilities, etc. This analysis will help in knowing the impact such mergers and acquisitions will have on the companies, their vision, and their future. AI-based calculations are more accurate as compared to manual calculations because businesses involve lengthy and hectic calculations involving cost, money, taxes, etc.

AI and Antitrust Investigations

Ø Antitrust Laws

Antitrust Laws, is also known as Anti-Competition Laws. These are the regulations which ensure fairness in competition by restricting the powers of the firms. This is basically done to ensure that the firms do not abuse the powers they have. The main aim is to make sure that, due to mergers or acquisitions, neither the firm is able to concentrate on the excess power nor is it is successful at forming monopolies. The law was designed to protect and promote fair competition within all firms. It “also prevents multiple firms from colluding or forming a cartel to limit competition through practices such as price fixing.”[6]

The Federal Trade Commission Act, the Sherman Act and the Clayton were those acts which had laid the foundation of the Antitrust Law.

Ø Anti- Competitive Agreements

The agreement is defined under section 3 of the Competition act. According to this section, if any agreement related to goods and service has an adverse effect on the nature of the competition, then it is prohibited in India.

There are two types of agreements:

Ø AI and Antitrust Investigations

Antitrust Investigation is done by DG[7] and the procedure for investigation of such a combination has been discussed under Section 29 and 41 of the Act. According to this Act, if any combination is formed using restrictive trade practices that can have a negative impact on the nature of competition, then an investigation will be done. In other words, an investigation is made to prosecute those who erode the nature of the free market. It promotes competition and innovation while protecting consumers, workers, and taxpayers. AI helps in identification of operational efficiency and estimated potential of the affected market that might lag if done manually.

The algorithm is considered to be one of the most essential components of AI. Without which AI is nothing. Ever since AI has been introduced in the world of law, the risk of collusion of algorithms generated by companies has increased. It helps people sitting in different parts of the world to come together and discuss different strategies, but sometimes, it makes it difficult for them to identify their real identity.

AI and Mergers and Acquisitions: New Considerations for Regulators

Ø What are Mergers and Acquisitions

M&A refers to the process of combining companies through mergers, acquisition and takeovers. “These transactions are driven by a variety of motives, including gaining access to new markets, technologies, or talent acquisitions as well as achieving cost efficiencies and synergies.”[8]

There are various stages involved in the process of M&A. It involves strategy making, identification of targets, valuation and post-merger integration. If these stages are performed effectively, then this M&A will become a success, otherwise it will turn into a failure. They have the power to shape the fortune of the company.

Ø Involvement of AI

M&A is a never-ending process and with the introduction of AI, it has increased. Following are the points that show how AI has become the part of M&A:

· “NLP and Document Analysis

· Advanced Predictive Analytics

· Enhanced Virtual Data Rooms

· Cross-Platform Integration

· Augmented Decision Support

· Ethical AI Framework”[9]

With time, AI will create more opportunities for industries to expand and acquire not only within the nation but also outside the nation. It will help companies to crack new deals while sitting in a place with less risk and more returns.

Even if this world is not challenge proof, protection of data privacy along with the regulation of cost would be the biggest challenge in future.

AI and Blockchain: Transforming Industries and the Future of Trust [10]

Ø What is Blockchain?

Blockchain is considered to be a decentralized and tamper-proof ledger technology that has contributed towards the revolution of data security and transparency. It was originally designed for cryptocurrencies, but now it is being used by various industries such as finance, healthcare, supply chain, manufacturing, etc. In other words, Blockchain is the foundation for digital transformation.

Ø AI and Blockchain

These days, industries are mostly dependent on data-driven decision-making dependent therefore, combining both AI and the Blockchain will establish a “secure groundwork for innovation”[11]. The combination will help in strengthening its security, growth and becoming more efficient.

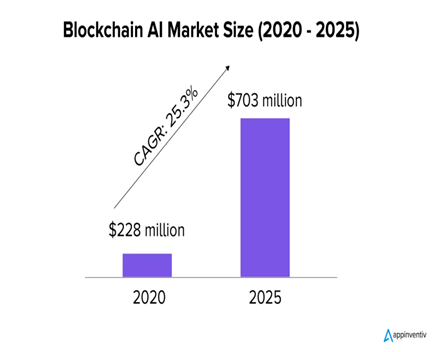

Undoubtedly, Blockchain has proved itself to be one of the “finest technologies” in which the market can invest and with time, due to AI, this trust of investors has reached another level. The following figure provides the reason behind this statement [12]

Ø Future of AI and Blockchain

This combination has the capacity to transform the work of industries by promoting “inclusivity and fairness”[13]. This duo will not only lead to the evolution of algorithms but will also bring a change in data ownership”. It will lead to more predictive and accurate analysis.

[1] Northern Pacific Railway Co. v. United States, 356 U.S. 1(1958)

[2] Northern Pacific Railway Company v. United States, Oyez (Jan 10, 2024, 09:13 AM), https://www.oyez.org/cases/1957/59

[3] V. Jeyaseelan, Competition Law, The Tamil Nadu Dr. Ambedkar Law University Chennai (Jan. 14, 2024, 11:24 PM), https://www.tndalu.ac.in/econtent/7_Competition_Law.pdf

[4] Ambarish Bharadwaj Sivashankaran, Cross Border Mergers and Competition Law, International Journal for Multidisciplinary Research (IJFMR) (Jan. 26,2024, 10:04 PM), https://www.ijfmr.com/papers/2023/3/2887.pdf

[5] AI and the Future of Mergers and Acquisitions, Institute for Mergers, Acquisitions & Alliances (Jan 26, 2024, 10:24 PM) https://imaa-insitute.org/the-future-role-of-artificial-intelligence-in-mergers-an-acquisitions/

[6] Alexander Twin, Antitrust Law: What They Are, How They Work, Major Examples, Investopedia( Jan. 15, 2024, 08:29 PM) https://www.investopedia.com/terms/a/antitrust.asp

[7] The Competition Act, 2002, No. 12, Acts of Parliament, 2003 (India)

[8] AI and the Future of Mergers and Acquisitions, Institute for Mergers, Acquisitions & Alliances (Jan 26, 2024, 01:30 PM) https://imaa-insitute.org/the-future-role-of-artificial-intelligence-in-mergers-an-acquisitions/

[9] AI and the Future of Mergers and Acquisitions, Institute for Mergers, Acquisitions & Alliances (Jan 26, 2024, 10:24 PM) https://imaa-insitute.org/the-future-role-of-artificial-intelligence-in-mergers-an-acquisitions/

[10] Chirag, Integration of AI and Blockchain: All You Need to Know, appinventiv (Jan. 14, 2024, 02:48 PM) https://appinventiv.com/blog/ai-in-blockchain/

[11] Chirag, Integration of AI and Blockchain: All You Need to Know, appinventiv (Jan. 14, 2024, 02:48 PM) https://appinventiv.com/blog/ai-in-blockchain/

[12] Chirag, Integration of AI and Blockchain: All You Need to Know, appinventiv (Jan. 14, 2024, 02:48 PM) https://appinventiv.com/blog/ai-in-blockchain/

[13] Chirag, Integration of AI and Blockchain: All You Need to Know, appinventiv (Jan. 14, 2024, 02:48 PM) https://appinventiv.com/blog/ai-in-blockchain/

#CompetitionLaw #AI #Antitrust #BusinessRegulations #MergersAndAcquisitions #CorporateLaw #ArtificialIntelligence #LegalTech #Blockchain #DigitalTransformation #FairCompetition #EconomicRegulations #TradePractices #LegalInnovation #AICompliance #BusinessEthics #DataPrivacy #RegulatoryTech #CrossBorderMergers #AIinLaw

コメント